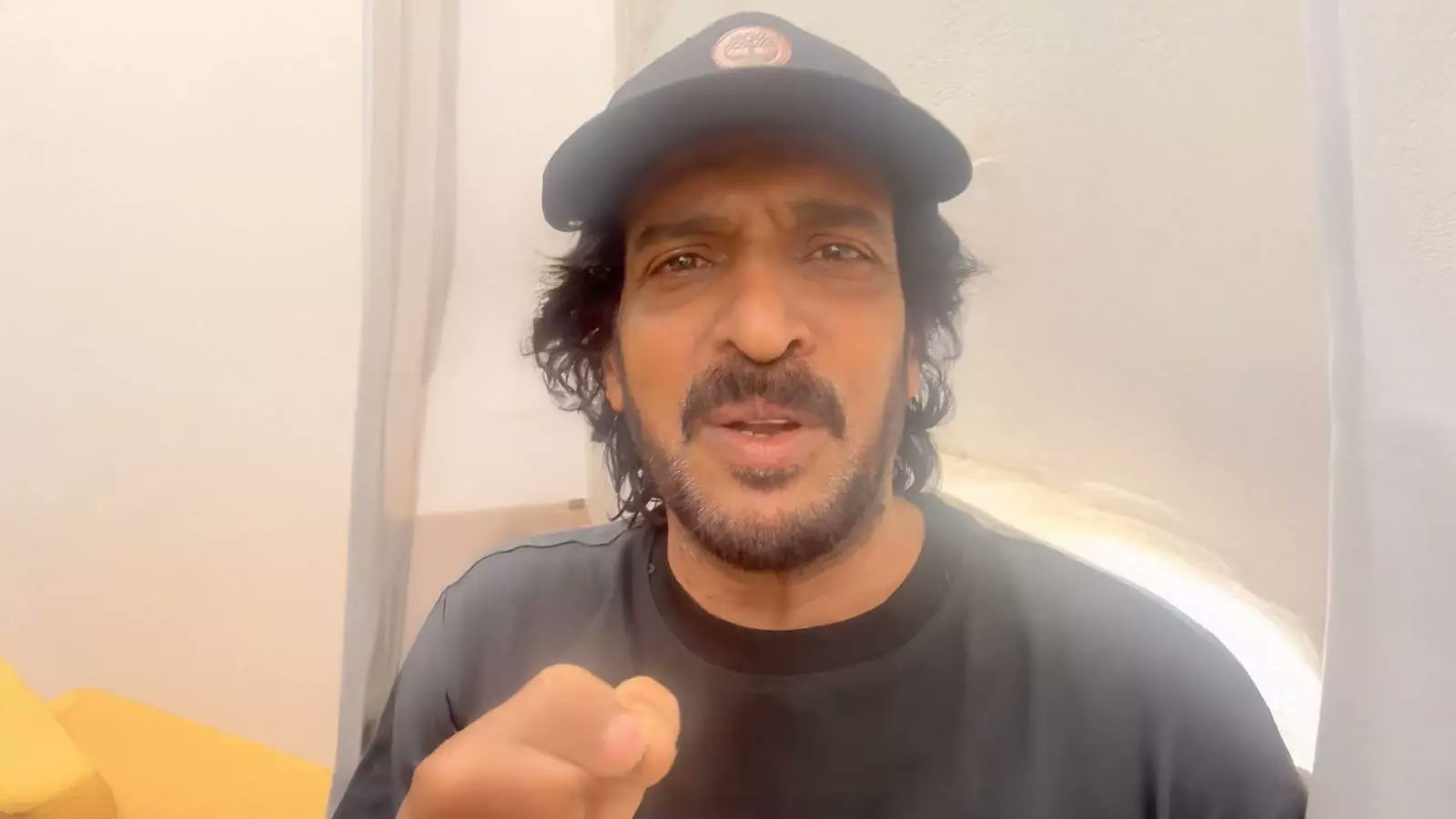

Upendra Rao and his wife Priyanka Upendra, Kannada cinema’s biggest star, were caught up in a highly sophisticated phone hack on September 15, 2025, that shocked India’s digital payments ecosystem to its core. What started as a normal courier alert soon turned into a nightmare: a cloned app injected malware, stole one-time passwords, and allowed fraudsters to drain funds through UPI transactions. Very far from a one-off celebrity hack, this hack revealed key weaknesses in mobile security and highlighted the need for more robust protection.

How the Hack Began with a Cloned Courier App

The attack relied on a deceptively disguised message that purported to be from a delivery firm. Priyanka, thinking it was real, clicked on a link that downloaded what she believed to be a tracking app. In fact, the program demanded far-reaching permissions—access to SMS, contacts, and screen management—and quietly took snapshots of UPI OTPs. When malware executed in the background, hackers posed as Upendra and Priyanka, initiating urgent payments to their contact list. In a matter of minutes, multiple UPI transfers were authorized without the victims being aware until it was too late.

Immediate Damage Control and Public Warning

Instead of making the episode private, Upendra and Priyanka sprang into action. They went live on social media to warn fans and friends, showing how to spot fake apps and disable nefarious permissions. At the same time, they reported the incident to the cybercrime unit and informed their bank, which froze pending transfers and reversed most of the unsanctioned transactions. Their openness made a personal crisis into an in-the-moment tutorial on phone hack recovery.

Basic Steps Following a Phone Hack

When your device is compromised, every second counts. First, remove any unfamiliar apps and reboot into safe mode to prevent malware from restarting. Next, change passwords and enable multi-factor authentication on financial and email accounts. Contact your bank to block suspicious transactions and file a complaint with cybercrime authorities, providing screenshots of the hack in action. Finally, back up important data and consider a full factory reset once you’ve secured account credentials.

Securing Your Phone with Smart Permissions

One of the most prevalent hack vectors is over-permissive apps. To guard against this, periodically review app permissions. On Android, go to Settings > Apps > Permissions to remove SMS, contact, or accessibility permission for apps you don’t completely trust. iPhone users can turn off Background App Refresh and limit Location Services under Settings > Privacy. Reducing permissions not only prevents malware from tapping sensitive information but also minimizes the attack surface for future attacks.

Securing UPI More Than OTPs

UPI speed and ease of use are based on OTP verification, but that is not foolproof by itself. To enhance security:

1. Turn on biometric or PIN verification for all transactions in your banking app.

2. Establish transaction limits for non-contacts, with large transfers needing manual authorization.

3. Whitelist preferred contacts for immediate transfers, so auto-approvals can’t be sent to unrecognized numbers.

4. Regularly check your UPI transaction history and report discrepancies at once.

These steps create more firewalls to prevent unauthorized fund transfers.

Detecting Phishing and Smishing Attempts

Phishing comes in the form of SMSes or WhatsApp messages masquerading as banks or services. Check for misspelled URLs, generic greetings, or demand for one-time passwords. Legitimate courier services will hardly ever demand excessive device permissions. If unsure, go search manually for the authentic app in your device store instead of clicking on in-app links. Developing awareness against phishing and smishing is your first line of defense.

Why High-Profile Hacks Matter

When a celebrity such as Upendra Rao becomes a victim of a mobile scam, it serves to prove that nobody—not even celebrities—is safe. Celebrity incidents raise public consciousness and usually prompt banks, regulators, and app developers to reinforce security measures. Here, banks advocated for voluntary biometric UPI authentication, while cybersecurity agencies sent out alerts regarding detection of cloned apps. The impact of one hack can extend to country-wide upgrades in digital security.

Role of Banks and Cybercrime Authorities

Collaboration among victims, law enforcement, and banks came in handy in retrieving money quickly. Cybercrime agencies have dedicated units to pursue app-based scams, track scam wallets, and work with payment networks. Banks also use real-time fraud detection software to detect suspicious patterns. Early reporting of an event comes in handy in initiating these safeguards before hackers move funds outside the reversal period.

Creating a Mobile Security Culture

Good security practices begin with learning. YouTube and Instagram tech communities now fill feeds with mobile security lesson videos, app-permission explanations, and UPI safety step-by-step tutorials. Corporates and user groups organize phishing link detection workshops and cloned-app identification training. Both experts and users help create a stronger digital environment by sharing knowledge ahead of time.

Going Forward: Real-Life Lessons

The Upendra Rao mobile hack reminded us of a number of valuable lessons:

– Always install apps from authentic stores and check the credentials of the developer.

– Routinely scan and restrict app permissions, particularly for sensitive operations such as SMS and contacts.

– Activate multi-factor authentication and biometric confirmations for banking app permission.

– Be wary of unsolicited links and access services manually via known portals.

– Respond in the moment—delete malicious apps, notify authorities, and freeze transactions if you spot something suspicious.

By embracing these habits, anyone can significantly minimize the risk of becoming a victim of UPI scams or phone hacks.

Turning a Crisis into Collective Vigilance

Upendra Rao’s phone hack was a grim reminder of what can happen when convenience trumps security. A potentially catastrophic scam turned into a great awareness campaign thanks to the honesty of the couple. As India’s digital payment economy grows, the experience of the high-profile hack will teach millions how to better protect themselves with mobile defenses. In a world where cyber threats change by the day, being informed and awake is our best defense.

Leave a Reply